What is a Qualified Opportunity Fund?

A qualified Opportunity Fund must be certified by the U.S. Treasury Department. Qualified Opportunity Funds must be organized as a corporation or partnership for the purpose of investing in designated Opportunity Zone Property and/or businesses. The qualified Opportunity Fund must hold at least 90% of its assets in designated Opportunity Zone Property.

Why invest in Qualified Opportunity Funds?

Join the #1 Network to Discover and Invest in Qualified Opportunity Funds

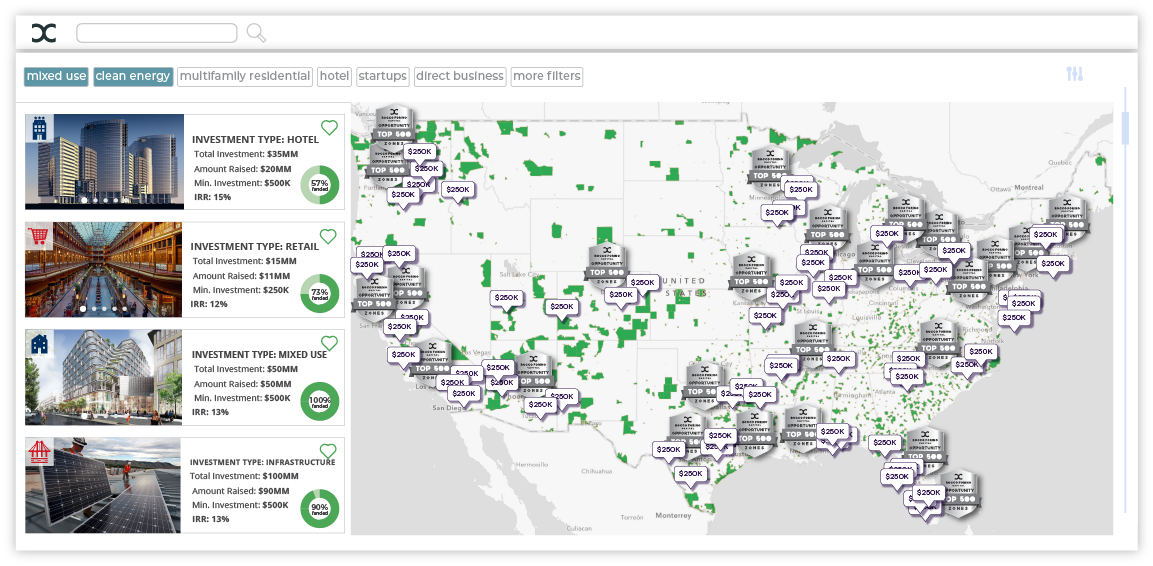

What is the RFC Deal Flow Network?

QOF Deal Flow

Investment Analysis

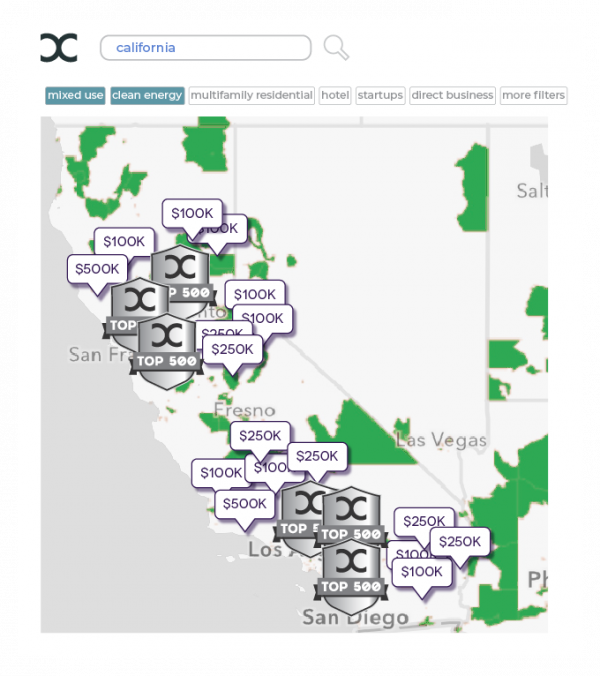

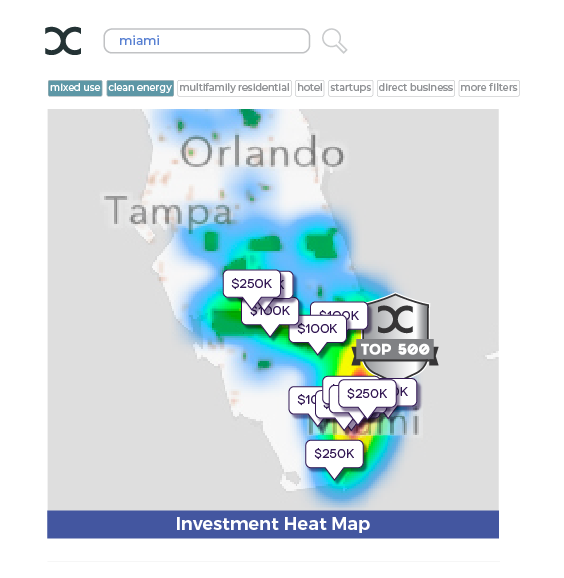

Heat Mapping

OZ Ranking

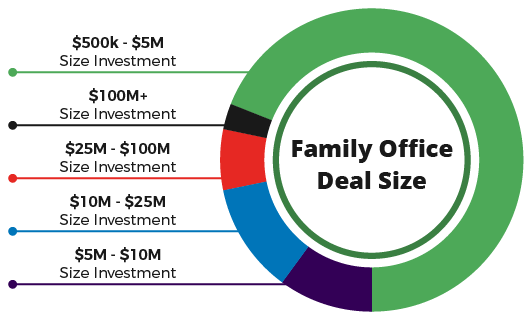

Family Office Deal Flow

Qualified Opportunity Funds Benefits:

![]() All Investor’s projected assets under

All Investor’s projected assets under

management total over $1 Trillion dollars

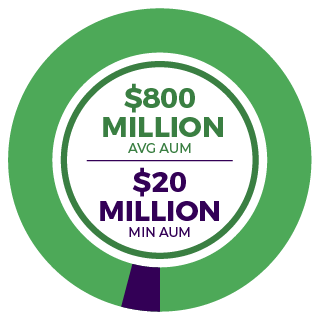

![]() Average assets under management

Average assets under management

is $800 Million dollars

firms and family office institutions than on any other network.

capital from family offices and wealth managers.

Top 10 Tips for Raising Capital From Family Offices

Qualified Opportunity Funds listed on this platform is by invitation only.

Benefits to Opportunity Zone Communities:

1 Advertise the Top 500 Opportunity Zones** badge on your community’s website to market your Opportunity Zones as a low risk high quality investment option.

2. Create community Engagement. Build a video profile of the community’s greatest needs so investors and fund managers can become familiar with the community and build solutions to solve these needs. Request RFC to create a video profile.

3. Transparency. Track who is investing in your OZ community and the types of investments being planned.

- Measure amount of capital scheduled to be deployed to each census tract

- Track new business starts as well as businesses receiving funding

- Track the number of full time non-construction jobs created

- Measure investments by dollar value and percentage assigned to each asset class

- Track total investments to date

4. Measurement. Use the OZ deal flow platform

to track and measure impact with the heat

mapping and analytical tools.

5. Get the #1 Book that instructs communities how to attract investors and entrepreneurs and build successful Opportunity Zones.

![]() For Opportunity Zones that qualify

For Opportunity Zones that qualify

Benefits to businesses located in an Opportunity Zone: