As of January 9th 2019 the IRS cancelled a key hearing on Opportunity Zones and would have focused on clarifying the nuances around tax breaks and proposed regulations under the new program. The government shutdown has put a major pause on clarifying some recurring questions investors have with the program.

Peter Brack founding partner of Hypothesis Ventures stated,

“With the government shutdown, the Opportunity Zone hearing scheduled for January 10th has been postponed indefinitely. This hearing was to address the over 150 comments submitted to the Federal Rulemaking Portal and the letters sent to the Treasury Department by working groups during the open comment period since the last round of guidance in October 2018. To the best of our knowledge this hearing will be rescheduled a few weeks after appropriations have been made, and guidance would be released thereafter.

Because the hearing and necessary guidance have been delayed indefinitely, an enormous amount of money designated for Opportunity Zones must sit on the sidelines. While real estate investors were waiting for final clarifications on some issues, non-real estate investors were hoping for broader guidance around operating businesses, fund structures, etc. The government shutdown does not change the structure or substance of the OZ program but merely delays the implementation of it and subsequently the ability of investors to deploy capital into Opportunity Zones.”

What is a Qualified Opportunity Zone Fund?

A Qualified Opportunity Zone Fund is any investment vehicle which is organized as a corporation or a partnership for the purpose of investing in businesses and or property located inside a qualified Opportunity Zone…also know as distressed communities.

The “Fund” must hold at least 90 percent of its assets in a qualified Opportunity Zone property and or businesses for a time period of not less than five years and at least 10 years to receive all the tax incentives and investment benefits. Opportunity Zone Funds can not be created to invest in other Opportunity Zone Funds, which is know as fund of funds.

An investment in an Opportunity Zone Fund may increase or decrease in value over the holding period and holds the same risks as any other alternative investment. In addition, income may be paid out on this investment. Given that the purpose of the program is to improve particular distressed communities, it is expected that the fund will continue to invest in the improvement of the property or business. Cash flow may occur once the property improvements are complete and the property is leased or sold to third parties.

As this investment will be a new option and the IRS and Treasury are still working on the specifics of how this fund will work over time, and as a result it is difficult to assess the level of risk associated with this type of fund. The risks may potentially include market loss, liquidity risk, and business risk to name just a few. Because this investment may not be appropriate for all investors, consult with your tax advisor before pursuing such an investment to determine if this fits with your risk profile and diversification of your investments.

The 2017 Tax Cuts and Jobs Act established the Qualified Opportunity Zone program to provide a tax incentive for private, long-term investment in economically distressed communities.

Investors in these programs are given an opportunity to defer and potentially reduce tax on recognized capital gains.

If you are facing significant tax payments as a result of capital gains, investing in a Qualified Opportunity Zone Fund contains distinct advantages over the section 1031.

What is an Opportunity Zone?

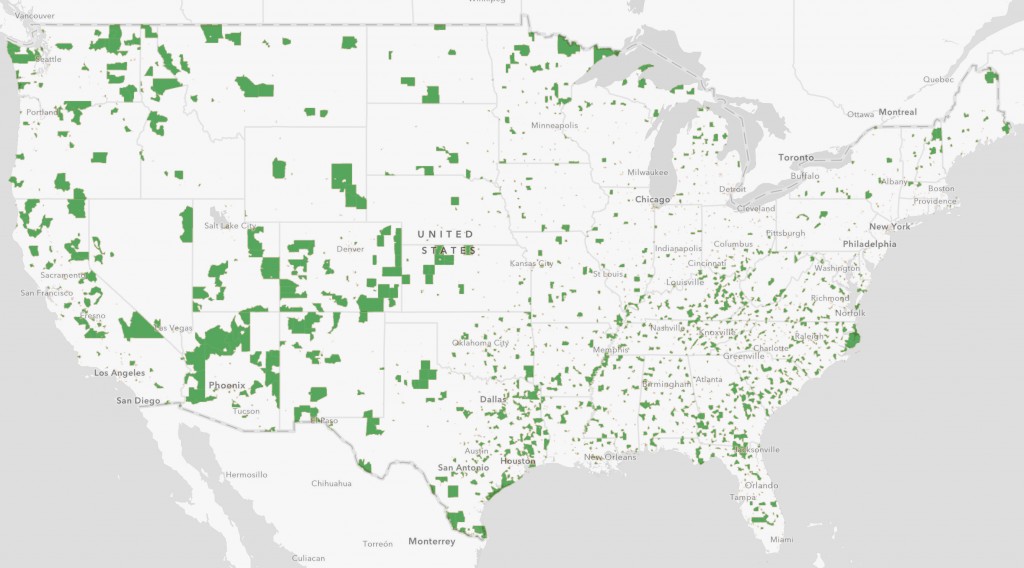

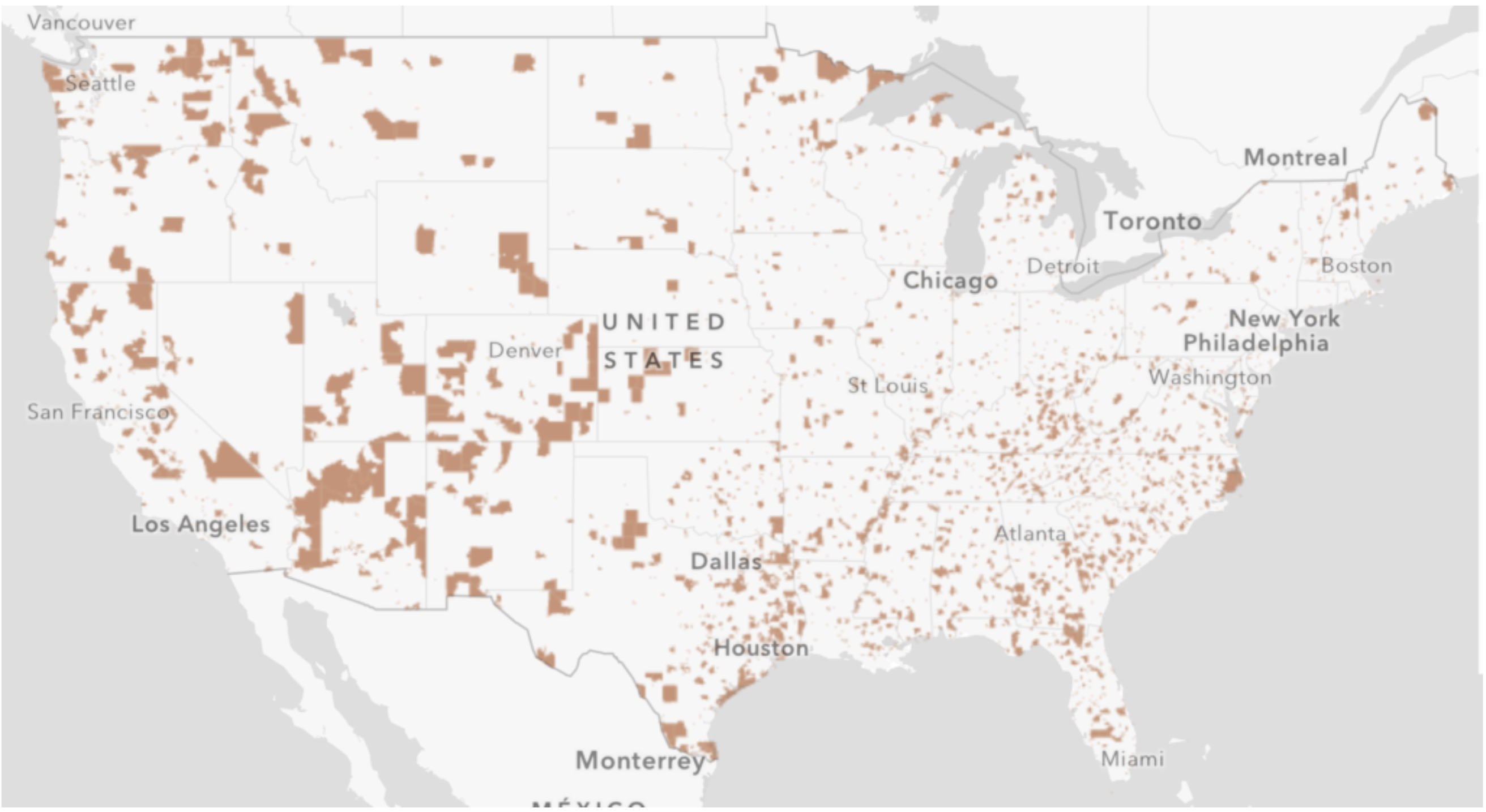

An Opportunity Zone is a distressed community nominated by each of the 50 states and is certified by the Treasury Department as qualifying for this program. As of June 14, 2018, the department certified zones in all 50 states, Washington, D.C., and U.S. territories.1 Distressed communities are the small towns and cities that have floundered through that last several economic cycles while primary and secondary cities have thrived. Distressed communities are town and cities that have experienced lack of sustained business growth, witnessed the shut down of factories and experienced shrinking skilled workforces and the majority of the community earn wages under the national poverty line.

Approximately 8,700 Opportunity Zones have been designated nationwide. To locate an Opportunity Zone near you, see the map below that shades the specific Opportunity Zones. Or go to our Opportunity Zone Map.

How does the Opportunity Zone Investment program work?

To defer a gain, a taxpayer has 180 days from the date of the sale or exchange of appreciated asset or security to invest the realized gain (typically a capital gain) into a Qualified Opportunity Zone Fund. The fund will then need to invests the capital gains in one of the 8,400 Qualified Opportunity Zones though out the United States.

The taxpayer may invest the return of principal as well as the recognized capital gain, but only the portion of the investment attributable to the capital gain will be eligible for the exemption from tax on further appreciation of the Opportunity Zone Investment, as explained below. The Opportunity Zone program allows for the sale of any appreciated assets, such as stock with a reinvestment of the gain into an Opportunity Zone Fund. There is no requirement to invest in a like-kind property to defer the gain.

Qualified Opportunity Zone Investments

A Qualified Opportunity Zone is any business or real estate found within the shaded portion of the U.S. Opportunity Zone map above. A qualified Opportunity Zone partnership interest or a qualified opportunity zone business property must be acquired after December 31, 2017, must be used in a trade or business conducted in a Qualified Opportunity Zone or ownership interest in an entity (stock and partnership interests) operating with such tangible property.

Investments qualify for Opportunity Zone business designation when:

A business is acquired by purchase;

- Most of the tangible property owned or leased by the taxpayer in the execution of their business activity is qualified Opportunity Zone business property;

- At least 50 percent of their business’ total gross income is derived from its meaningful management and operation;

- A substantial portion of the business’ intangible property is used in the active conduct of the trade or business;

- Less than five percent of the average aggregate unadjusted basis of their property is attributable to non-qualified financial property; and

- The business is not a private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.

Investments qualify for Opportunity Zone business property designation when:

- A property was acquired by the qualified Opportunity Fund after 2017;

- The property began to be used when the qualified Opportunity Fund began operating in the Opportunity Zone;

- The qualified Opportunity Fund substantially improved the property;

- During the qualified Opportunity Fund’s holding period, almost all of the use of the property was in a qualified Opportunity Zone.

Investment in Opportunity Zone Assets must be Substantially Improved

Tax Cuts and Jobs Act of 2017:

“Property is considered to be substantially improved if, during any 30-month period beginning after the date of acquisition of such property, additions to basis with respect to such property in the hands of the qualified opportunity fund exceed an amount equal to the adjusted basis of such property at the beginning of such 30-month period in the hands of the Qualified Opportunity Fund.”

Interpretation:

It is considered “Substantially Improved” if the property is improved by over 100% of the basis within 30 months of acquisition. The reference to adjust basis means the adjusted basis of any preexisting tangible property in an Opportunity Zone at the end of 30-month period following acquisition.

For instance, if an Opportunity Zone Fund acquires existing real property in an Opportunity Zone for $1 million, the fund has 30 months to invest an additional $1 million for improvements to that property in order to qualify for this program. Improvements in a Qualified Opportunity Zone do not include golf courses, country clubs, massage parlors, hot tub facilities, suntan facilities, race tracks or other facilities used for gambling, or liquor stores.

Tax deferral and savings

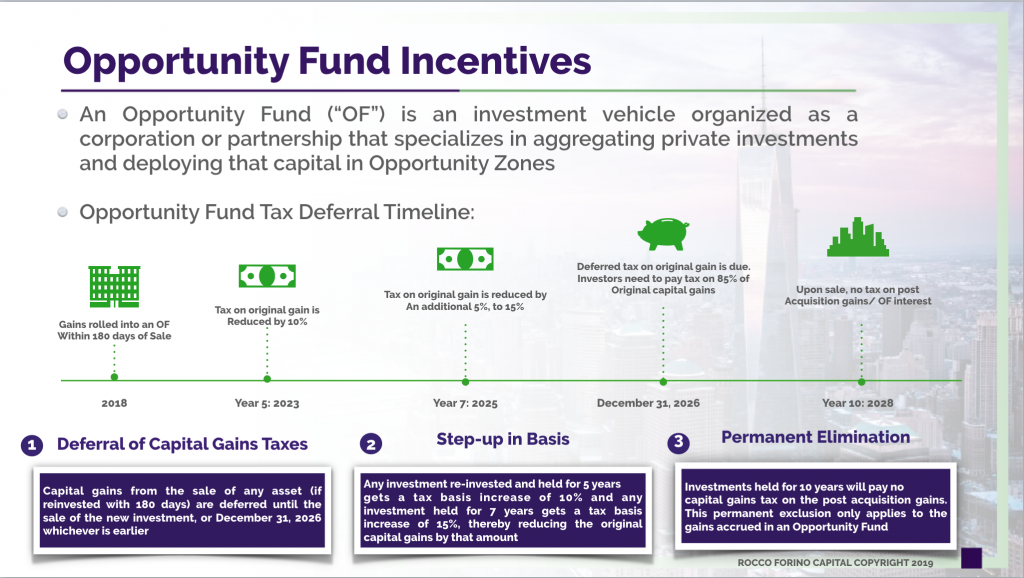

An Opportunity Zone Fund investment provides potential tax savings in three ways:

Tax deferral through 2026 – An investor may elect to defer the tax on some or all of a capital gain if, during the 180 day period beginning at the date of sale/exchange, they invest in a qualified opportunity fund. Any taxable gain invested in an Opportunity Zone Fund is not recognized until December 31, 2026, (due with the filing of the 2026 return in 2027) or until the interest in the fund is sold or exchanged, whichever occurs first. In addition, the deferred gain can be further reduced as described below.

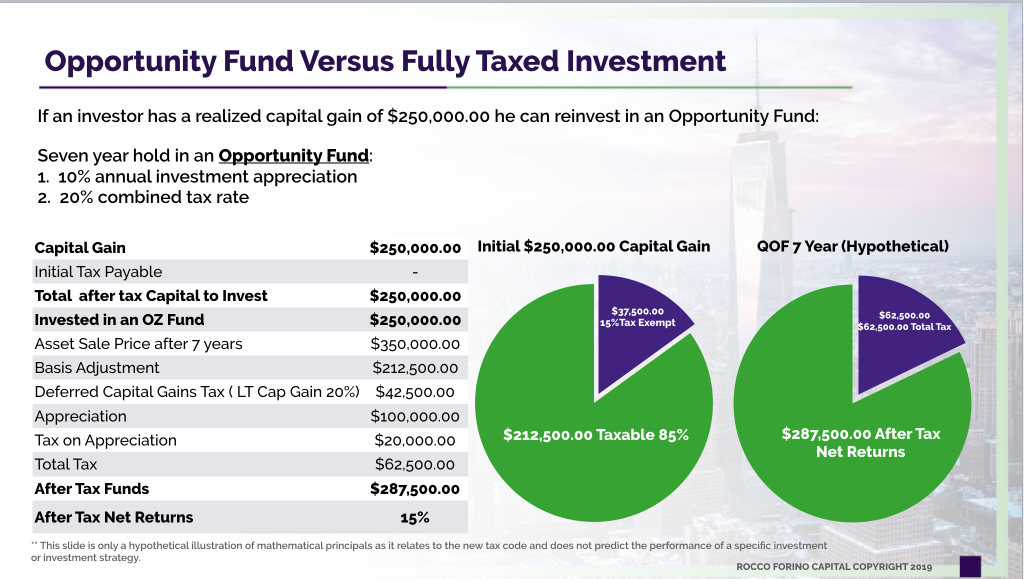

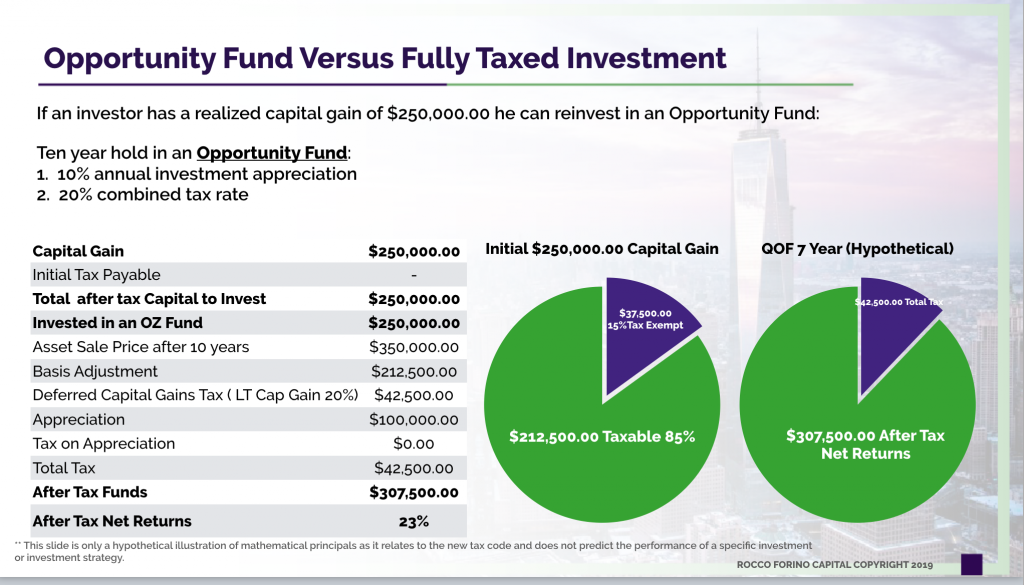

No tax on 10% or up to 15% of deferred gains – An investor who defers gains through an Opportunity Zone Fund investment receives a 10% step-up in tax basis after five years and additional 5% step-up after seven years. When the tax is triggered at the end of 2026, the investor will have held the investment in the fund for seven years, thereby qualifying for the 15% increase in tax basis. As you can see below in the left pie graph, on a $250,000.00 capital gain that is held in an Opportunity Fund, the investor is only taxed on 85% of the gain or the $212,500.00 portion.

No tax on appreciation – Remaining in the qualified opportunity fund for at least ten years, the investor is only taxed on 85% of the initial $250,000.00 capital gain and avoids paying taxes on the investment’s appreciation from $250,000.00 to $350,000.00 a $100,000.00 tax free gain.

Tax deferral through 2026

The gain deferral applies to any investment gain (for example, sale of appreciated stock or a business). It is important to note that the tax cannot be deferred indefinitely – only until 2026. The tax savings, however, may still be significant. Qualifying for deferral does not require an intermediary, and the taxpayer has 180 days from a sale to invest the gains into an Opportunity Zone Fund.

Example: In January 2018, a taxpayer sells a zero-basis business for $250,000.00, resulting in a $250,000.00 capital gain. The taxpayer invests the entire amount in a Qualified Opportunity Zone Fund within 180 days. None of the sale proceeds are taxable in 2018. At current federal capital gains rates, this allows the taxpayer to keep over $$50,000.00 that would otherwise have been taxed as capital gain (based on the current IRS rate of 20%) and paid in the 2018 tax year and instead invest it in the Qualified Opportunity Zone Fund. Assuming even a conservative rate of return on that $50,000.00, it could provide a significant return to the taxpayer over the length of the investment.

What If The Qualified Opportunity Fund Experiences a Loss?

The investor is still eligible for the increase in basis for holding the investment for five or seven year period. The taxpayer’s recognized gain for 2026 (or the year of divesting from the fund) will be the lesser of the original deferred gain or the fair market value of the fund interest reduced by the taxpayer’s adjusted basis in the fund, if any. Because of the complicated nature of these investments and the fact that the rules are still under review, consult with your tax advisor before committing any funds.

Example: Assume after seven years, the Opportunity Zone Property is sold at a 20% loss. Let’s presume the investor balance after the loss is $200,000.00 from the Opportunity Zone Fund (80% of the original $250,000.00 investment). Since the taxpayer held the investment for seven years, the taxpayer receives a 15% increase in basis, or $37,500.00 (this means of the initial capital gain of $250,000.00, $37,500.00 is exempt from being taxed).

The balance of the initial capital gain realized would be $162,50.00 ($200,000.00 – $37,500.00). Since the investor is selling at a loss of 20%, he would pay taxes on the lesser of the original gain or the loss adjusted “capital gain.”

When the government shutdown ends, and the IRS reconvenes its meeting to address questions related to Opportunity Zones, we will provide a follow up briefing with the latest updates.

Rocco Forino is the Managing Partner of Rocco Forino Capital, a value investing company de-risking investments in Opportunity Zones and OZ Funds by educating investors, stakeholders and communities through our research, data analysis, investor relations tools, conferences, podcasts, videos, certification programs and Opportunity Fund deal syndication.

Since Opportunity Zones (Oz’s) are distressed communities and RFC specializes in the valuation of distressed assets, we are well-positioned to evaluate communities, real estate and businesses based on their ability to transition from being distressed to becoming the next thriving economic hub.

For more information about investing in Opportunity Funds click on the button below.

Leave A Comment